During the operation and production process of a factory, machinery, equipment, and the factory building itself undergo wear and tear. Therefore, when investing in factory buildings or machinery, businesses must always consider the lifespan and depreciation period of the factory. So, how many years is the depreciation period for a factory building? The following article will help businesses calculate the most accurate depreciation time.

Nội dung

1. Regulations on Fixed Asset Depreciation

1.1. How to Identify Fixed Assets

Tangible Fixed Assets

Tangible fixed assets are those with physical form and independent structure.

They may be systems consisting of many separate parts meeting the criteria: used for more than one year and having an original cost of 10,000,000 VND or more.

Factory buildings are considered tangible fixed assets.

Examples include equipment, production machinery, factory space, and supporting devices such as air conditioners, fans, lighting systems, etc.

Intangible Fixed Assets

Intangible fixed assets do not have a physical form.

These assets exclude factory buildings, construction works, architecture, and have values ranging from 5,000,000 to under 10,000,000 VND with a usage time of more than one year.

1.2. Scope of Depreciation for Fixed Assets

According to Article 12, Circular 45/2018/TT-BTC, the scope of fixed asset depreciation includes:

-

Fixed assets at public service units that must cover regular and investment expenses.

-

Fixed assets of public service units subject to full depreciation calculation as regulated.

-

Fixed assets of public service units within the scope defined in Article 2, points a and b.

1.3. Principles of Depreciation Calculation

Businesses must follow the regulations applicable to depreciation.

For fixed assets used for business, leasing, or partnership, depreciation starts from the day the asset is put into use and stops when the asset is no longer used.

Depreciation expenses are allocated to specific activities for accurate cost accounting.

Factory buildings begin depreciation once operational.

1.4. Determining Useful Life and Depreciation Rates

Depending on climate and weather conditions affecting wear, depreciation rates should not exceed 20% per year according to the reference table below:

| No. | Asset Category | Useful Life (years) | Depreciation Rate (% per year) |

|---|---|---|---|

| Category 1 | Buildings and Construction Works | ||

| – Grade I (High standard) | 80 | 1.25 | |

| – Grade II | 50 | 2 | |

| – Grade III | 25 | 4 | |

| – Grade IV | 15 | 6.67 | |

| Category 5 | Machinery and Equipment | ||

| 1 | Common machinery and equipment | ||

| – Desktop computers, printers, fax machines, scanners, shredders, filing cabinets | 5 | 20 | |

| – Photocopiers | 8 | 12.5 | |

| – Office desks and chairs for staff | 8 | 12.5 | |

| – Meeting room tables and chairs | 8 | 12.5 | |

| – Air conditioners | 8 | 12.5 | |

| – Fans | 5 | 20 | |

| – Heaters | 5 | 20 | |

| – Other common machinery and equipment | 5 | 20 | |

| 2 | Machinery and equipment serving general activities of agencies, organizations, units | ||

| a | Machinery and equipment similar to common office equipment as listed above | Same as point 1, Category 5 | Same as point 1, Category 5 |

| b | Other machinery and equipment serving general activities | ||

| – Projectors, water filters, dehumidifiers, vacuum cleaners | 5 | 20 | |

| – TVs, video players, other digital receivers | 5 | 20 | |

| – Audio equipment | 5 | 20 | |

| – Other communication equipment | 5 | 20 | |

| – Network and communication devices | 5 | 20 | |

| – Office electrical equipment | 5 | 20 | |

| – Surveillance cameras | 8 | 12.5 | |

| – Elevators | 8 | 12.5 | |

| 4 | Other machinery and equipment | 8 | 12.5 |

| Category 7 | Other fixed assets | 8 | 12.5 |

1.5. Depreciation Calculation Methods

Depreciation is calculated based on annual depreciation rates.

The formula for annual depreciation is:

Annual Depreciation = Original Cost × Depreciation Rate (%)

Cumulative depreciation at year n = Depreciation until year (n-1) + Depreciation in year n (increases or decreases).

2. Formula for Calculating Factory Building Depreciation Years

According to Circular 45/2013/TT-BTC dated March 25, 2013, by the Ministry of Finance:

-

Depreciation is the systematic allocation of the original cost of fixed assets to production and business expenses over the depreciation period.

-

The depreciation period is the required time for businesses to recover investment costs through depreciation.

For new factory buildings, depreciation years are based on Appendix 1 of Circular 45/2013/TT-BTC.

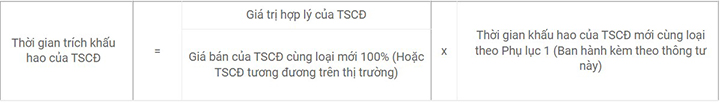

For factory buildings already in use, the depreciation period is calculated as:

3. Depreciation Period Framework for Factory Fixed Assets

The depreciation periods according to Appendix 1 of Circular 45/2013/TT-BTC are:

| Asset Group | Minimum Depreciation Period (years) | Maximum Depreciation Period (years) |

|---|---|---|

| A – Power Machinery and Equipment | ||

| 1. Power generators | 8 | 15 |

| 2. Power generators (hydraulic, thermal, wind, gas mix) | 7 | 15 |

| 3. Transformers and power supply equipment | 7 | 15 |

| 4. Other power machinery and equipment | 6 | 15 |

| B – Other Industrial Machinery and Equipment | ||

| 1. Machine tools | 7 | 15 |

| 2. Machinery used in mining | 5 | 15 |

| 3. Tractors | 6 | 15 |

| 4. Machinery for agriculture and forestry | 6 | 15 |

| 5. Water pumps and fuel pumps | 6 | 15 |

| 6. Metallurgy and metal surface treatment equipment | 7 | 15 |

| 7. Specialized equipment for chemical production | 6 | 15 |

| 8. Machinery for producing building materials, ceramics, glass | 10 | 20 |

| 9. Machinery for electronic components, optics, precision mechanics | 5 | 15 |

| 10. Machinery for leather, printing, stationery, and cultural products | 7 | 15 |

| 11. Machinery for textile industry | 10 | 15 |

| 12. Machinery for garment industry | 5 | 10 |

| 13. Machinery for paper industry | 5 | 15 |

| 14. Machinery for food production and processing | 7 | 15 |

| 15. Machinery for cinema and medical fields | 6 | 15 |

| 16. Machinery for telecommunications, IT, electronics, and broadcasting | 3 | 15 |

| 17. Machinery for pharmaceutical production | 6 | 10 |

| 18. Other working machinery | 5 | 12 |

| 19. Machinery for oil refining industry | 10 | 20 |

| 20. Machinery for oil and gas exploration and exploitation | 7 | 10 |

| 21. Construction machinery | 8 | 15 |

| 22. Cranes | 10 | 20 |

| C – Measuring and Testing Instruments | ||

| 1. Instruments measuring mechanical, acoustic, thermal quantities | 5 | 10 |

| 2. Optical and spectroscopic instruments | 6 | 10 |

| 3. Electrical and electronic instruments | 5 | 10 |

| 4. Instruments for physico-chemical analysis | 6 | 10 |

| 5. Radiation measuring instruments | 6 | 10 |

| 6. Special industry instruments | 5 | 10 |

| 7. Other measuring and testing instruments | 6 | 10 |

| 8. Molds used in casting industry | 2 | 5 |

| D – Transportation Equipment | ||

| 1. Road vehicles | 6 | 10 |

| 2. Rail vehicles | 7 | 15 |

| 3. Water transport vehicles | 7 | 15 |

| 4. Air transport vehicles | 8 | 20 |

| 5. Pipeline transport equipment | 10 | 30 |

| 6. Loading and lifting equipment | 6 | 10 |

| 7. Other transport equipment | 6 | 10 |

| E – Management Tools | ||

| 1. Computing and measuring equipment | 5 | 8 |

| 2. IT equipment, electronics and management software | 3 | 8 |

| 3. Other management tools | 5 | 10 |

| G – Buildings and Architectural Structures | ||

| 1. Solid buildings | 25 | 50 |

| 2. Rest areas, canteens, toilets, changing rooms, parking shelters | 6 | 25 |

| 3. Other buildings | 6 | 25 |

| 4. Warehouses, tanks; bridges, roads, airport runways; parking and drying yards | 5 | 20 |

| 5. Embankments, dams, culverts, canals, ditches | 6 | 30 |

| 6. Ports, dry docks | 10 | 40 |

| 7. Other architectural structures | 5 | 10 |

| H – Livestock and Perennial Trees | ||

| 1. Livestock | 4 | 15 |

| 2. Industrial trees, fruit trees, perennial trees | 6 | 40 |

| 3. Lawns and green covers | 2 | 8 |

| I – Other tangible fixed assets not categorized above | 4 | 25 |

| K – Other intangible fixed assets | 2 | 20 |

See more articles:

-

Cost estimate for building a 200m² factory

-

Full-package quotation for pre-engineered steel frame factory construction

4. Real-life example of factory depreciation calculation

Company A has built a factory with a total investment of VND 3 billion.

Thus, the original cost (initial value) of the factory is VND 3,000,000,000.

The useful life of the factory is: 25 years.

Therefore, the annual depreciation of the factory is:

3,000,000,000 ÷ 25 years = VND 120,000,000/year

(A small error in the original version: if the original cost is 3 billion VND, then the annual depreciation should be 120 million VND, not 80 million.)

Monthly depreciation:

120,000,000 ÷ 12 months = VND 10,000,000/month

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国)